Jefferson County Foundation continues the hard work of bringing truth to light and holding state and federal agencies accountable for following the law. We’re busy gearing up for new legal actions and really need your support at this time. In honor of Earth Week, donations will be matched, so for a limited time, your donation will go twice as far. Please send a donation to the Foundation Legal Fund. To update you on our work:

Educate and Empower the Public

This past week, we presented the Foundation’s scientific team’s work at the virtual 2021 National Watershed and Stormwater Conference. The presentation was a case study of Rockwool entitled, “Stormwater Management in Karst Environments: What Could Possibly Go Wrong? A Lot.” There were several representatives from the federal Environmental Protection Agency (EPA) in attendance along with stormwater experts from across the country. It was a good opportunity to get our story out to watershed professionals.

The Foundation received more than 8,600 documents from the city of Ranson as a result of a FOIA. We also recently received documents from the EPA as a result of a FOIA. We are currently reviewing their contents.

The Foundation is eagerly awaiting the return of FOIA from another federal agency. We are working hard to get the agency to respond and will keep you posted on our progress.

We also have a new video to share that talks about Toxic Release Inventories, Human Health and Environment Risk Scores for Rockwool’s Mississippi plant and how it would compare to entities already in the Eastern Panhandle.

Advocate to Regulators and Leaders

The West Virginia Department of Environmental Protection (DEP) and the EPA are both refusing to respond to the Foundation’s letter regarding Rockwool’s inaccurate and incomplete form submission for Resource Conservation and Recovery Act (RCRA), which requires the company to notify the EPA about how it intends to handle regulated waste at its facility. We will continue to press on this issue. Read the full letter here.

The DEP approved the Sheetz, Inc. Construction Stormwater General Permit (CGP) on March 18, 2021, which was on or about the same day that they asked the company to post the sign at its new warehouse/transfer operation in the Burr Industrial Park. This left no time for the public to have proper notice or to be able to respond with concerns to the permit. This CGP registration should not have been approved at least until the public notice sign had been posted for a sufficient amount of time for the public to have an opportunity to notice the sign and review the registration application (at least 30 days). The DEP continues to bypass the rules to benefit the permittee while ignoring potential environmental risks and bypassing public notification. The Foundation will continue to insist the DEP follow the requirements of the law in this and other Stormwater Permit matters.

Legal Updates

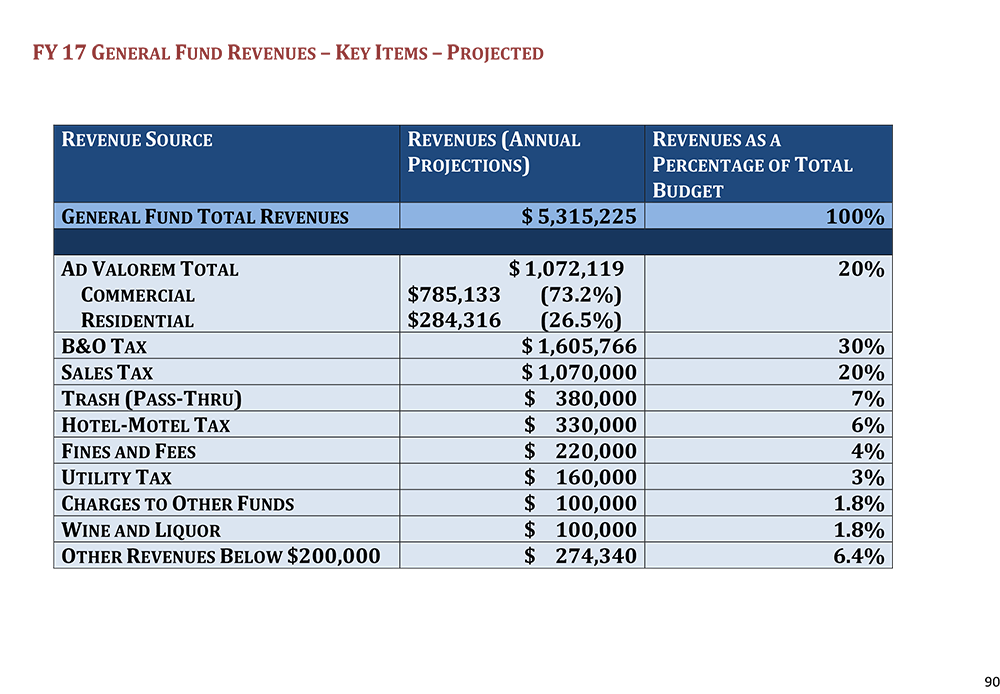

Appeal Filed in Case Re: Constitutionality of the $150M Tax Abatement Deal with WVEDA

The Foundation filed a Notice of Appeal on March 24 in the legal challenge of the constitutionality of the $150 Million tax abatement deal the WVEDA made with Rockwool. We are working on the necessary legal research to prepare briefs. For more information about this case and our view of lease buy back agreements in general, read here.

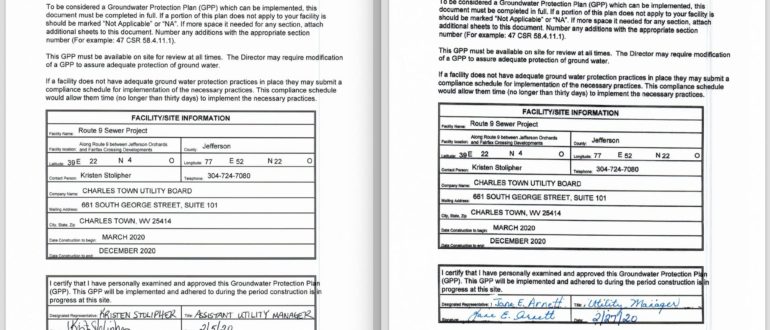

Rockwool Stormwater Construction Permit – Findings of Fact and Conclusions of Law

The Foundation is working on the Findings of Fact and Conclusions of Law briefs in our case versus the WVDEP and Rockwool that challenges Rockwool’s Construction Stormwater permit. Once all parties submit their briefs, we will wait for the EQB to render their decision. For more information on this case, please read here.

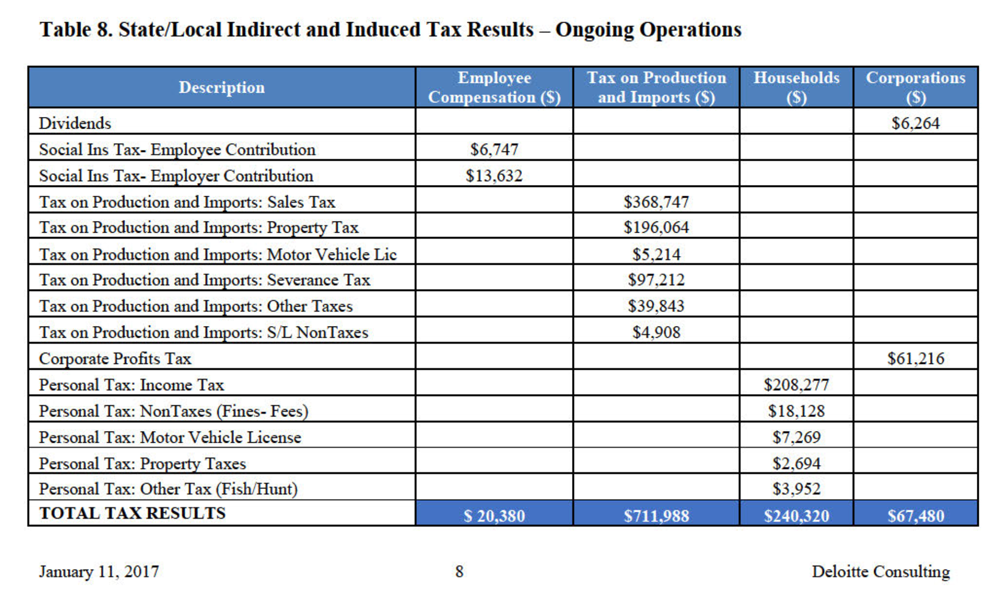

Preparing for Discovery for Rockwool’s Operational Stormwater Permit Appeal

The Foundation continues to work on discovery in the appeal of Rockwool’s operational stormwater permit. Yet again, Rockwool and the DEP are failing to cooperate with the procedures required by law. Jefferson County Foundation has submitted over 8,000 pages of discovery documents in response to Rockwool’s request. Rockwool and the DEP have continued to refuse to produce any discovery. On the threat of a motion to compel, Rockwool has produced what amounts to 32 documents, one of which made each page a separate document (which makes it look like they produced 139 documents). The Foundation is hip to the tricks of corporate lawyers that have nothing to produce because they have no defense of their case. Read the appeal.

New Lawyers on Board

The Foundation is working with two new groups of lawyers in two different areas of applicable law. Stay tuned for more action updates in this space.

Support our Foundation’s Work

The discovery process and specialized lawyers are expensive, but necessary for our legal strategy to be successful. We appreciate your support while we are conducting this process. Please, if you are able, consider a donation to the Foundation Legal Fund. You can donate safely and easily online at the Foundation’s website. You can also help by sending a check to Jefferson County Foundation, Inc., PO Box 460, Ranson, WV 25438.

For those that are contributing, we thank you for your dedication to bring truth to light and to protect our natural resources and urge you to continue to donate. We appreciate your continued support! In the meantime, we’ll keep you posted on how our active cases are going.